HMRC: Blueprint for ‘Government as a Platform’

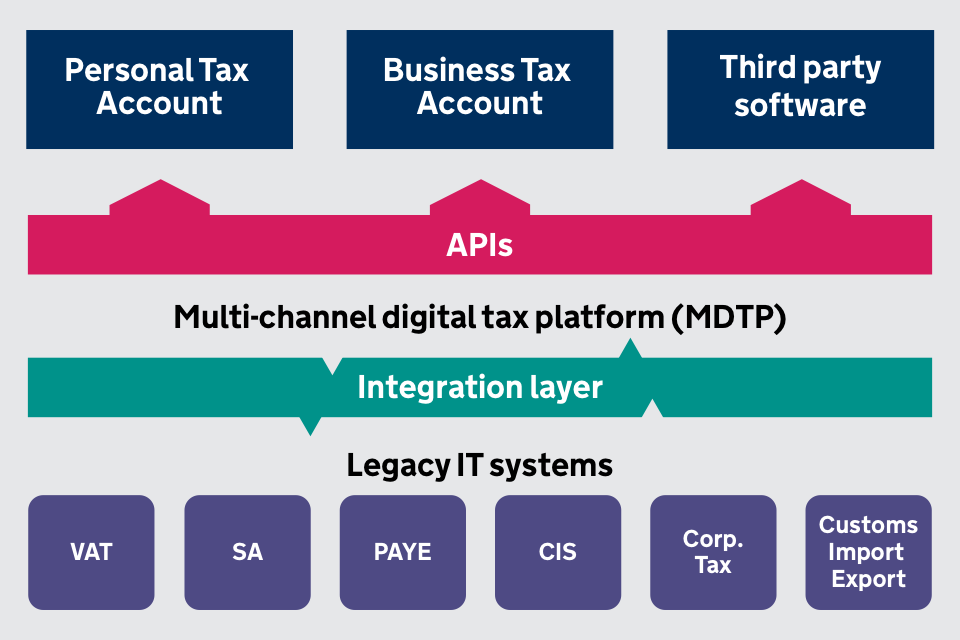

HMRC's Multi-channel Digital Tax Platform (MDTP) employs Continuous Delivery at scale, operating a cloud platform for over 130 user-facing applications powered by over 1000 microservices.

A key design principle for Digital Government is ‘Government as a Platform’.

A key design principle for Digital Government is ‘Government as a Platform’.

Coined by Tim O’Reilly to define how Governments can adopt a technology paradigm pioneered by the likes of Amazon and Netflix, and represents the application of Platform Engineering practices to public sector IT.

The UK is a global leader in this field. Gov.uk’s Digital Service Platform offers a keynote exemplar of how to operate a platform architecture and make it accessible to a developer community.

HMRC

For a detailed examination of how GaaP is implemented this HMRC webinar presentation offers a blueprint case study.

Speaking at the DevOps Enterprise Summit HMRC presented on: “Saving the Economy From Ruin with a Hyperscale PaaS“. The talk was delivered by Ben Conrad, Head of Agile Delivery, HMRC and Matt Hyatt, Technical Delivery Manager, Equal Experts.

In March 2020 the United Kingdom went into pandemic lockdown, causing the most brutal recession in living memory. The Government had to react quickly, with policies to help citizens and businesses cope.

This required HMRC to rapidly implement a range of new services, such as The Coronavirus Job Retention Scheme, The Self Employment Income Support Scheme and the Eat Out to Help Out Scheme.

Once these initiatives were announced, the UK’s Tax Department (HMRC), needed to encode these policies as digital services, capable of dealing with huge spikes in traffic. And it had to be designed, implemented and delivered in a matter of weeks.

The platform and services needed to deliver financial support to more than 12 million employed and self-employed workers via the three schemes outlined above. In just a matter of weeks, the team was ready and the platform withstood 67,000 job claims within half an hour of the Job Retention Scheme going live. It also handled 440,000 applications for government grants via the Self Employment Income Support Scheme on the first day of its operation.

Platform Engineering

What made this possible was HMRC’s Platform strategy. Their Multi-channel Digital Tax Platform (MDTP) – which employs Continuous Delivery at scale, began development in 2014. It is a cloud platform for over 130 user-facing applications, powered by over 1000 microservices that have been built as part of HMRC’s ‘making tax digital’ strategy. It provides an easy way for teams to build and deploy applications that can scale to handle millions of requests.

This enables business domains within HMRC to fund a small cross-functional team to develop a microservice or collection of microservices, rapidly developing and deploying new customer facing services. The platform provides a suite of common components that makes this possible.

Delivery at Scale

HMRC is the largest digital platform in the UK Government, and the platform enables the very large scale delivery, encompassing:

- Hosting of 1,200 microservices.

- Built by 2,000+ developers, split into 70 teams across 8 geographic locations.

- Making over 100 deployments per day.

New digital services are developed by a cross-functional team of developers, interaction and content designers, QAs, business analysts et al, and the platform provides all the functionality for the team to create and deploy services such as Github, automated pipelines and telemetry tooling and dashboards. It also includes collaboration apps.

Guardrails

The central principle to success is the concept of an “opinionated platform”, or simply guardrails. Basically this means a set of rules that must be followed, that are ‘baked in’ to the platform, and by operating within those rules developers are then free to work rapidly and make large volumes of changes without approval. Example rules include:

- Microservices must be written in Scala, using the Play framework.

- Persistence must be achieved by using Mongo.

The primary benefit of this platform approach is the ease by which they could meet the dramatic scale required. Having a platform composed of immutable infrastructure defined as code meant they could size the platform to meet the size of demand.

Given the scale of the traffic due to the pandemic situation there were still key challenges. For example HMRC could take steps to assure and test performance of their own apps, but when they relied on third parties via APIs they could not, so they had to take steps such as setting these up as asynchronous calls.

The other key challenge was MDTP had to interface to HMRC’s legacy application estate, mostly still running on mainframes. This was addressed by migrating data from these systems into temporary data stores on MDTP.

Conclusion

MDTP offers an exemplar blueprint for an enterprise Platform strategy.

This is a powerful story of how the right combination of culture, technology and focus can empower a large organisation to pivot fast and efficiently, resulting in the rapid delivery of digital services that are user-centric, maintainable, performant and resilient.